Table of Contents

Understanding EU Conflict Minerals & US Conflict Minerals Responsible Sourcing Regulations

The EU Conflict Minerals Regulation and Section 1502 of the U.S. Dodd-Frank Act are both regulatory measures aimed at curbing the negative impact of conflict minerals mining. Conflict minerals, which include tin, tungsten, tantalum, and gold (3TG), are often sourced from areas riddled with human rights abuses, armed conflict, and governmental instability. The profits generated from mining these minerals usually fund the groups perpetuating these issues.

EU Conflict Minerals Regulation

The EU Conflict Minerals Regulation was enacted on January 1, 2021. The regulation applies to EU-based importers of 3TG sourced from conflict-affected and high-risk areas (CAHRAs). The regulation covers all imported 3TG, including processed metals, mineral ores, or concentrates. Upstream companies, including those involved with mines, smelters, refiners, etc., fall within the scope of the regulation. They must conduct due diligence and report on imported 3TG. Downstream companies that import or distribute end-user products containing 3TG or source finished components are currently exempt from the regulation. However, downstream companies are encouraged to report on their use of 3TG voluntarily.

Reporting Requirements for EU Conflict Minerals Regulation

Upstream companies are required to follow the Organization for Economic Cooperation and Development (OECD) Guidance, which has a 5-step framework for due diligence. Additional requirements for upstream companies include:

- Sharing supply chain data with downstream purchasers.

- Publicly reporting due diligence policies and practices.

- Publishing conflict minerals summary reports of annual third-party supply chain audits.

Dodd-Frank Conflict Minerals Act Section 1502

The U.S. Dodd-Frank legislation Act was enacted on July 21, 2010, with a specific Section 1502 focused on conflict minerals compliance. Section 1502 applies to publicly traded companies that manufacture products containing 3TG sourced from the Democratic Republic of the Congo (DRC) or any surrounding countries within the scope of the regulation and are required to submit a Specialized Disclosure - FORM SD along with their annual SEC filling

Reporting Requirements for the US Conflict Minerals Act

If 3TG is necessary for the functionality or production of a product, the product falls within the scope of Section 1502. This requires public companies to conduct due diligence by tracing the 3TG back to the utilized smelter to determine where the minerals originated.

Public companies are required to file a Conflict Minerals Report and must follow the due diligence process of a nationally or internationally recognized framework, such as the OECD Due Diligence Guidance. The due diligence process results in one of three determinations, each with its own set of requirements.

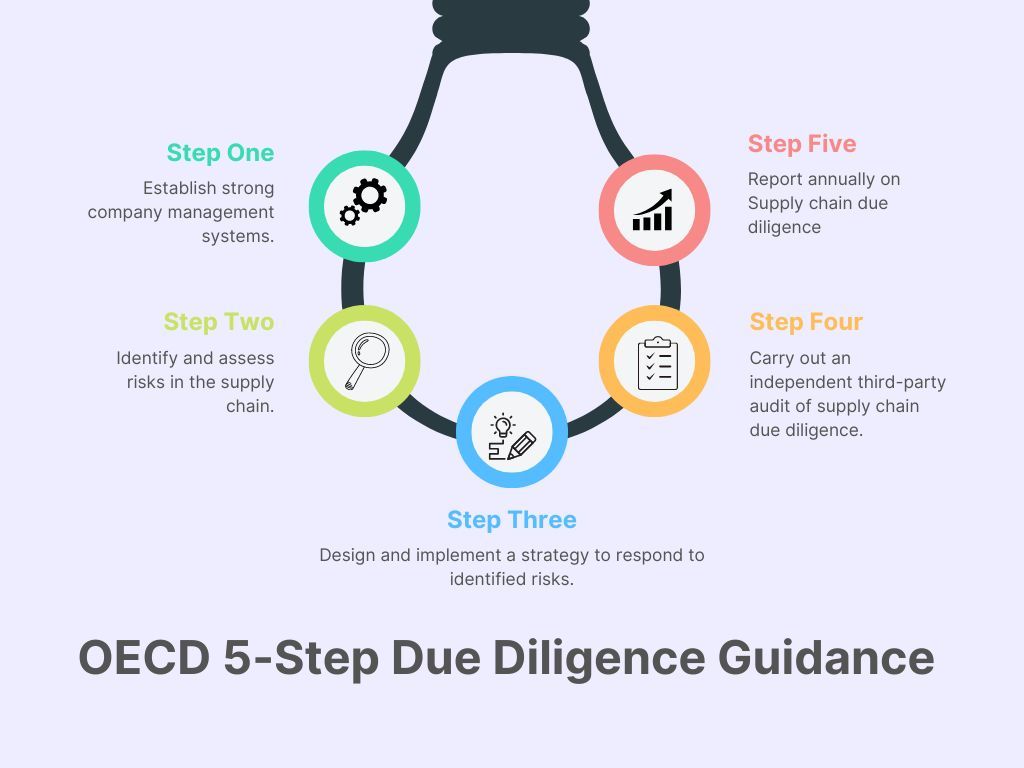

OECD 5-Step Due Diligence Guidance

- Step 1: Establish strong company management systems.

- Step 2: Identify and assess risks in the supply chain.

- Step 3: Design and implement a strategy to respond to identified risks.

- Step 4: Carry out an independent third-party audit of supply chain due diligence.

- Step 5: Report annually on Supply chain due diligence

Key Differences Between the EU Conflict Minerals Regulation and Section 1502 of the U.S. Dodd-Frank Conflict Minerals Act

Although both regulatory measures share similar goals, there are some key differences between them. For instance, The Dodd-Frank Act applies only to companies that are publicly traded in the United States, while the EU Regulation applies to all companies that import minerals into the EU. This means that the EU Regulation has a much broader scope, and more companies are likely to be affected by it.

In addition, the EU Regulation requires companies to conduct due diligence on their supply chains to identify and mitigate the risks of conflict minerals. This due diligence process must conform to international standards and must be conducted in a way that is consistent with the OECD Due Diligence Guidance. In contrast, the Dodd-Frank Act does not specify a particular due diligence process that companies must follow but instead requires them to report on their efforts to determine the source and chain of custody of conflict minerals.

Another important difference is the types of minerals that are covered by the regulations. The Dodd-Frank Act focuses on four minerals: tin, tantalum, tungsten, and gold, which are commonly referred to as 3TG. The EU Regulation, on the other hand, covers a broader range of minerals, including tin, tantalum, tungsten, ores, and gold, as well as other minerals and metals that are associated with human rights abuses.

Despite these differences, there are also some similarities between the two regulations. For example, both regulations require companies to disclose information about their use of conflict minerals, and both regulations aim to address the problem of conflict minerals by promoting responsible sourcing practices.

How Acquis Conflict Minerals Software can help companies comply with both the EU Conflict Minerals Regulation and Section 1502 of the U.S. Dodd-Frank Act.

Acquis Conflict Minerals Compliance Solution can help companies comply with conflict minerals regulations with a comprehensive set of software and services including:

- Monitor Compliance Status

Keep track of your suppliers' compliance status easily. Use tools to stay updated and address any risks quickly.

- Global Supplier Engagement

Communicate with suppliers worldwide through user-friendly multilingual support. Clear communication helps ensure everyone meets compliance requirements.

- Plan Your Compliance Roadmap

Create a clear plan for conflict minerals compliance. Set steps and milestones to ensure your supply chain adheres to regulations.

- Execute RCOI Due Diligence

Conduct Reasonable Country of Origin Inquiry (RCOI) due diligence through supplier CMRT declarations and smelter validation. This helps ensure accurate data and compliance.

- Budget-Friendly Compliance Reporting

Use budget-friendly solutions for easy compliance reporting. Automated tools can simplify data collection, analysis, and reporting, saving you time and money.

By leveraging expertise and technology, Acquis can help companies streamline & automate conflict minerals compliance processes and ensure meeting obligations under conflict minerals regulations.

Reach out to our Conflict Minerals Compliance experts to streamline your compliance process