Table of Contents

The electronics industry stands as one of the foremost consumers of PFAs presently. However, both the European Union (EU) and the United States are progressing towards implementing sweeping bans, compelling industries to gradually eliminate these hazardous PFAs substances.

The company asserts that PFAs chemicals have been integral to numerous consumer products for decades. Within the EU, the electronics and semiconductor sector consumes approximately 4,400 metric tons of PFAs annually. It is speculated that this figure could surge nearly tenfold to nearing 100,000 metric tons within the next three decades.

The World of PFAs

PFAs encompass a vast family of chemical compounds, with thousands of variants. Commonly known members include Perfluorooctanoic Acid (PFOA), Perfluoro octane Sulfonate (PFOS), and Polytetrafluoroethylene (PTFE). These chemicals have found their way into various electronic applications, making it essential to understand their potential hazards.

PFAs in Electronics: Common Applications

-

Semiconductors: PFAs are utilized in the manufacturing process of semiconductors, enhancing their performance and longevity.

-

Printed Circuit Board Assemblies (PCBAs): PFAs are used in the manufacturing process of printed circuit boards to make them more resistant to heat and chemicals. They provide dielectric properties and improve the soldering process.

-

Computer Hard Drives: PFAs are used in the coating of hard drive components to reduce friction and improve durability.

-

Wire and Cable Coatings: PFAs are sometimes used in coatings for wires and cables, providing them with resistance to heat, chemicals, and moisture.

-

Electronic Displays: PFAs are used in the manufacturing of electronic displays, such as LCDs (liquid crystal displays), to enhance their moisture resistance and improve the overall display quality.

-

Aerospace and Defense Electronics: PFAs coatings are used in electronic components for aerospace and defense applications where resistance to extreme environmental conditions is crucial.

Why is PFAs commonly used by manufacturers of electronic devices

-

Chemical Stability: PFAs exhibit high resistance to chemical reactions and degradation over time.

-

Thermal Stability: They can endure elevated temperatures without breaking down or emitting harmful by-products.

-

Low Surface Tension: PFAs possess a low surface tension, making them effective for creating non-stick surfaces, such as those found on cookware.

-

High Thermal and Electrical Insulation: These compounds offer excellent thermal and electrical insulation properties, making them valuable in electronic components and thermal insulation applications.

-

Hydrophobicity: PFAs are highly water-repellent, which is advantageous for water-resistant coatings and firefighting foams.

-

Lubricity: They also provide lubricating properties, serving as effective release agents or lubricants in various manufacturing processes.

These characteristics make PFAs a preferred choice for manufacturers seeking durable and sustainable materials for electronic component production.

The Hazards of PFAs in Electronics

The primary concern with PFAs lies in their persistence in the environment and can accumulate in the Human Body, water, and soil, potentially contaminating local ecosystems. The carbon-fluorine bonds within PFAS are incredibly strong, making them resistant to breakdown. Consequently, exposure to PFAS over extended periods can lead to various health problems, including:

-

Cancer: Several studies have linked PFAs exposure to an increased risk of cancer, particularly testicular and kidney cancers.

-

Liver Damage: Exposure to PFAs has been associated with liver damage, including increased levels of liver enzymes and fatty liver disease.

-

Increased Cholesterol Levels: PFAs exposure has been associated with elevated cholesterol levels, which can contribute to heart disease.

-

Reproductive and Developmental Disruption: PFAs exposure can interfere with reproductive and developmental processes, potentially leading to birth defects and fertility issues.

Regulation of PFAs in Electronics

Environmental regulations aim to control and restrict the use of PFAs in electronics. These regulations can be broadly categorized into two types:

- *Reportable PFAs: The regulations only pertain to PFAs intentionally added to products, not those present as impurities. For example, Pentadecafluorooctanoic acid (PFOA, CAS# 335-67-1) is subject to reporting requirements in the European Union, listed on the EU REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) candidate list of Substances of Very High Concern (SVHC).

In Maine, specific reporting requirements for PFAs are mandated, while in the United States, the Toxic Substances Control Act (TSCA) necessitates companies to disclose their use of PFAs in products under TSCA Section 8(a)(7).

Similar reporting requirements for PFAs are anticipated to be implemented in Canada and other states across the United States.

- Restricted PFAs: Long-chain PFAs, particularly PFOA, are restricted due to concerns regarding their persistence and toxicity, both in Europe and North America.

In Europe and Switzerland, regulations include:

EU Persistent Organic Pollutants (POP): An acceptable threshold of 25 parts per billion (ppb).

EU REACH Annex XVII, entry 65: Restrictions on C9-C14 linear and/or branched perfluorocarboxylic acids (C9-C14 PFCAs), their salts, and related substances. This includes specific acids such as PFNA, PFDA, PFUnDA, PFDoDA, PFTrDA, and PFTDA, along with their salts and precursors.

In North America:

United States of America: Under the Toxic Substances Control Act (TSCA), certain PFAs like PFOA and PFOS have been identified by the Environmental Protection Agency (EPA) as priority chemicals for regulation.

US State of Maine: Plans to ban PFAs by 2030 involve prohibiting the sale and distribution of products intentionally containing PFAs by January 1st, 2030 unless designated as unavoidably necessary by the Department of Environmental Protection (DEP).

Canada: Under the Canadian Environmental Protection Act (CEPA), there's a proposed restriction on the manufacture, use, and release of long-chain (LC) PFAs into the environment.

Verifying PFAs in Electronics

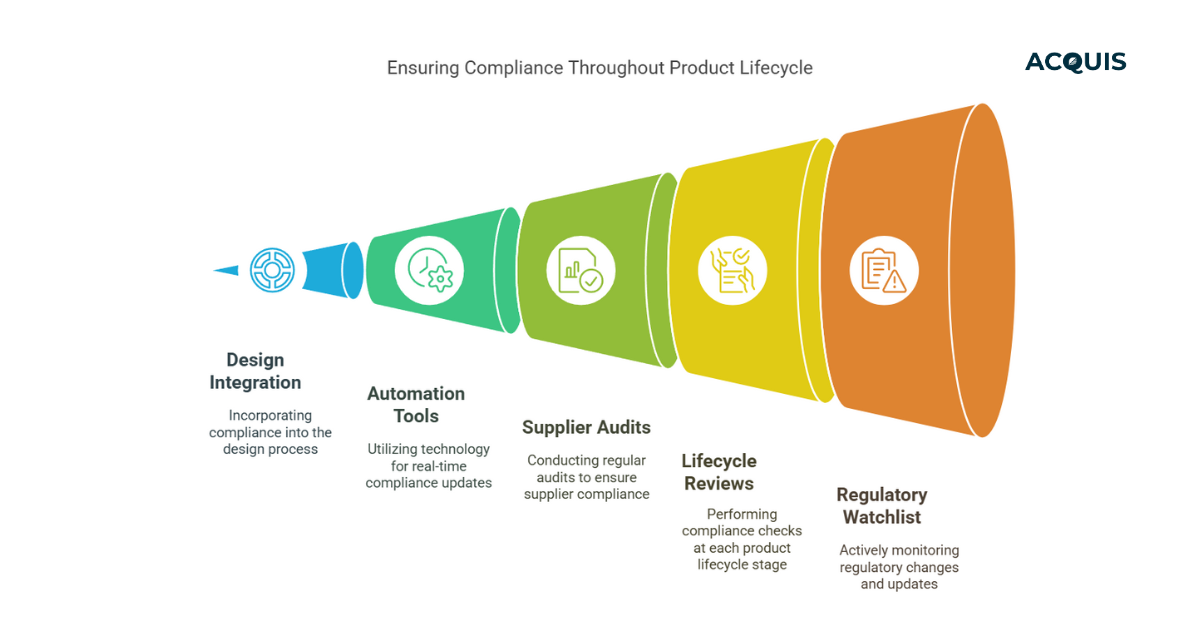

To ensure compliance with regulations and mitigate risks associated with PFAs, thorough verification is essential. Here are steps to verify PFAs presence in electronics:

-

*Audit Your Supply Chain:* Examine your supply chain for potential sources of PFAs. Request certificates of compliance, test reports, material disclosures, and safety data sheets from your suppliers.

-

Conduct Risk Assessment: Evaluate the risk posed by PFAs in your electronics. Consider factors like exposure pathways, potential harm, and the volume of PFAs used.

-

Analytical Testing: When necessary, implement analytical testing procedures to detect and quantify PFAS in your electronic components.

-

Expert Consultation: Consult with environmental and chemical analysis experts who specialize in PFAS detection. They can guide you on appropriate testing methods and interpret results.

Conclusion

Per- and Polyfluoroalkyl Substances (PFAs) are a growing concern in the electronics industry due to their persistence, bioaccumulation potential, and associated health risks. Understanding the applications, hazards, and regulations surrounding PFAs is crucial for manufacturers and suppliers in the electronics sector. By auditing supply chains, conducting risk assessments, and implementing analytical testing, companies can take proactive steps to ensure compliance and reduce the environmental and health impacts of PFAs in electronics.

Want to mitigate risk and streamline PFAs compliance in electronic devices? Book your free consultation with our compliance experts today.