Table of Contents

What You Need to Know about Conflict Minerals And Why You Need to Act Now

Conflict minerals—tantalum, tin, tungsten, and gold (3TG)—are embedded in nearly every modern industry, from electronics and automotive to aerospace and defense. These minerals drive technological innovation, but they also fuel armed conflict, human rights violations, and environmental destruction.

Despite over a decade of regulatory frameworks like Dodd-Frank Section 1502 and the EU Conflict Minerals Regulation, the problem isn’t going away. Supply chains remain opaque, companies still struggle with traceability, and compliance failures carry serious consequences—financial, legal, and reputational.

To learn in-depth download The Complete Guide to Conflict Minerals Reporting eBook here

The reality is clear: If your company sources 3TG minerals without a structured compliance program, you’re exposed to massive risk.

Let’s break it down.

Why Conflict Minerals Are Still a Global Problem

1. The Supply Chain is Still Murky

Most manufacturers don’t mine their own minerals—they rely on a long, complex chain of suppliers, smelters, and refiners before raw materials even reach production lines. This makes tracing the origins of minerals difficult, and “conflict-free” claims mean nothing without verification.

2. Human Rights & Forced Labor Violations Persist

Many mines in the Democratic Republic of the Congo (DRC) and neighboring regions are controlled by armed militias and corrupt governments, where:

- Child labor is rampant—some miners are as young as 7 years old.

- Workers are often unpaid or forced to work at gunpoint.

- Unsafe conditions lead to thousands of deaths annually.

3. Illegal Trade Fuels Global Instability

Illicit mining operations in conflict zones fund warlords, insurgent groups, and political corruption. Even when companies aren’t intentionally sourcing from these regions, lack of supply chain oversight allows tainted minerals to enter the global market.

4. Environmental Devastation is a Growing Concern

Illegal mining leads to:

- Deforestation – Mines destroy vast ecosystems, displacing communities.

- Toxic waste dumping – Heavy metals like mercury contaminate water supplies.

- Irreversible damage to biodiversity – Entire regions become uninhabitable.

If you’re not auditing your direct and indirect suppliers, there’s no way to know if your business is inadvertently supporting these issues.

Industry Breakdown: Who’s Most at Risk?

Electronics: The Powerhouse of 3TG Demand

Conflict minerals are used in circuit boards, semiconductors, capacitors, and soldering components.

- Intel, Apple, and Dell have led the way in conflict-free sourcing, but even they struggle with full transparency.

- Smaller manufacturers often lack resources for robust supply chain audits, leaving them vulnerable to compliance failures.

Automotive: A Hidden Reliance on 3TG

Think conflict minerals are just a tech industry problem? Think again. Automotive manufacturers use 3TG in:

- Catalytic converters

- Infotainment & navigation systems

- Electrical components & sensors

Without comprehensive supplier assessments, automakers risk violating regulations and damaging brand reputation.

Aerospace & Defense: High-Risk but Low Visibility

From jet engines and avionics to military-grade electronics, aerospace companies can’t afford sourcing scandals—yet the sector remains one of the least transparent when it comes to 3TG compliance.

- Boeing, Lockheed Martin, and Airbus have strict sourcing policies, but lower-tier suppliers often lack proper due diligence.

- Regulatory scrutiny is increasing, and the industry must adapt before enforcement tightens further.

Regulatory Compliance: What You’re Required to Do (No Excuses)

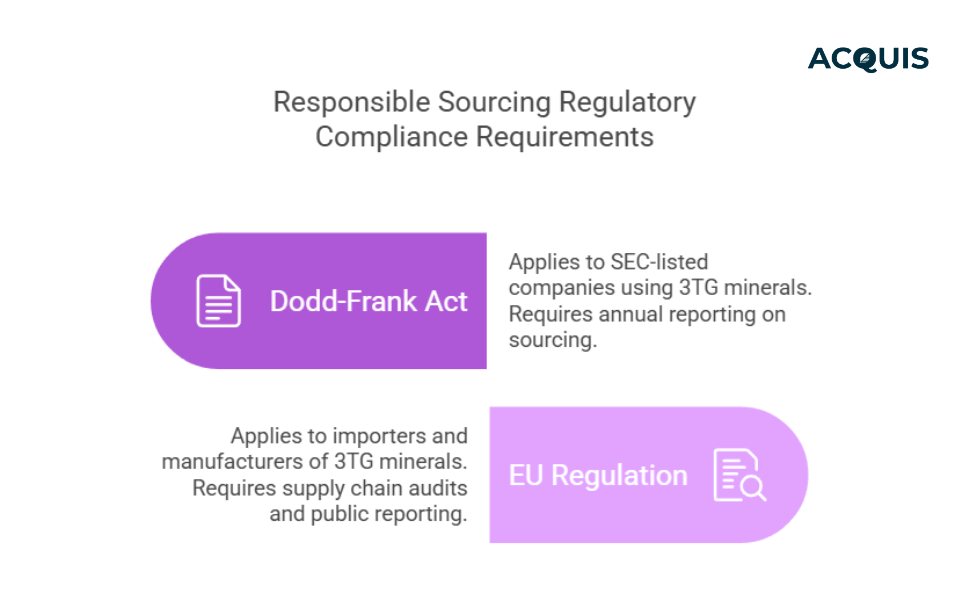

Dodd-Frank Section 1502 (U.S.)

- Applies to all SEC-listed companies that use 3TG minerals.

- Requires annual reporting on mineral sourcing and due diligence.

- Non-compliance leads to SEC penalties and reputational risk.

EU Conflict Minerals (Regulation 2017/821)

- Applies to importers and manufacturers using 3TG minerals.

- Requires full supply chain audits and public reporting.

- OECD 5-Step Framework is mandatory.

| Regulation | Who It Affects | Key Requirement | Risk of Non-Compliance | |---------------|------------------|----------------------|------------------| | Dodd-Frank Act (Section 1502) | SEC-listed companies using 3TG | Annual conflict minerals disclosure | SEC penalties, loss of investor trust | | EU Conflict Minerals Regulation | Importers & manufacturers | Full due diligence & third-party audits | Legal penalties, import restrictions |

Note: Even if you’re not directly regulated, your customers probably are—meaning you’ll need to provide compliance documentation or risk losing business.

How to Actually Get Compliant (Not Just Check a Box)

You can’t afford half-measures. A true conflict minerals compliance program requires:

1. Full Supply Chain Mapping

- Identify ALL suppliers and smelters involved in your sourcing.

- Verify material origins back to the mine level where possible.

2. Supplier Due Diligence

- Require Conflict Minerals Reporting Templates (CMRTs) from all suppliers.

- Use certified conflict-free smelters whenever possible.

3. Independent Auditing & Certifications

- Enforce Responsible Minerals Assurance Process (RMAP) certification.

- Conduct third-party audits to verify compliance.

4. Advanced Traceability Systems

- Implement blockchain or AI-driven tracking to monitor material flow.

- Automate supplier compliance checks to reduce manual effort.

5. Transparent Reporting & Public Disclosures

- Publish annual Conflict Minerals Reports to investors and customers.

- Clearly communicate your conflict-free sourcing policies.

The goal isn’t just compliance—it’s risk mitigation and long-term sustainability.

How Acquis Helps You Stay Ahead of the Curve

Tired of manual spreadsheets and supplier headaches? Acquis automates your conflict minerals compliance.

At Acquis Compliance, we simplify conflict minerals compliance with a fully automated, cost-effective solution designed to streamline your supply chain transparency, due diligence, and reporting.

- Automate Compliance Processes – Eliminate manual data collection with seamless CMRT management and smelter validation.

- Centralized Data Management – Gain full visibility across your global supply chain in one integrated platform.

- Real-Time Risk Assessment – Track supplier and product compliance, ensuring proactive risk mitigation.

- Regulatory Assurance – Stay ahead of Dodd-Frank, EU Conflict Minerals Regulation, and ESG requirements with built-in compliance checks.

- Global Supplier Engagement – Engage vendors worldwide with multilingual support for smooth collaboration.

- Effortless Compliance Reporting – Reduce costs by up to 40% while ensuring 100% reporting accuracy.

Final Takeaway

Conflict minerals compliance isn’t optional. The risk to your supply chain, reputation, and bottom line is too high to ignore. The companies that act now will be the ones that win customer trust, avoid penalties, and future-proof their operations.

So the question is: Are you ready to take control of your supply chain?

Stay compliant. Reduce risk. Build a resilient, sustainable supply chain.

Book a Demo and simplify compliance with Acquis today!