Table of Contents

If you’re treating compliance as an afterthought in your budget, you’re already behind.

Compliance isn’t a “nice to have”—it’s an absolute necessity. And like any critical business function, it requires funding. The challenge? Many companies either underestimate compliance costs or scramble for a budget only when an audit or regulatory deadline looms.

Let's explore how to budget smartly for compliance success, avoid financial surprises, and ensure your program is sustainable year after year.

Why Compliance Budgeting Matters

Imagine this:

You’re three months from a major product launch when you discover a critical component may contain a restricted substance. You now have two options:

- Pay for expedited lab testing and reengineering—a massive, unplanned expense.

- Delay the launch, losing revenue and damaging customer trust.

Both are bad choices, and both are avoidable—if you budget for compliance upfront.

Budgeting for compliance isn’t just about spending money—it’s about avoiding much bigger costs down the road.

Key Factors in Compliance Budgeting

So, what exactly should you be budgeting for? Let’s break it down:

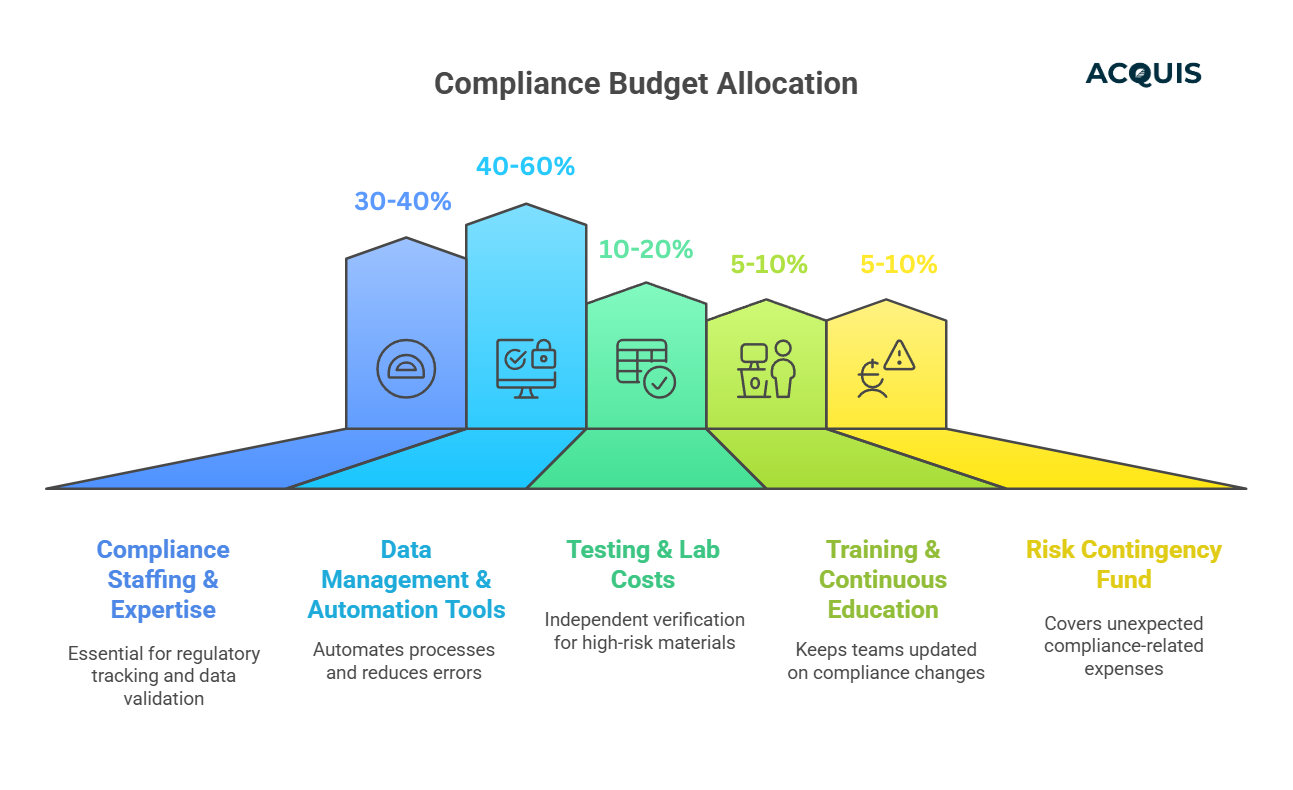

1. Compliance Staffing & Expertise

A strong compliance team isn’t optional. Whether you build an in-house compliance team or work with consultants, you’ll need:

- Regulatory experts to track changing laws (REACH, RoHS, TSCA PFAS, etc.).

- Supplier engagement specialists to collect and validate compliance data.

- Testing coordinators to oversee lab verifications for high-risk materials.

Ignoring staffing needs leads to compliance becoming an after-hours, side project—and that’s when costly mistakes happen.

Tip: Allocate 30-40% of your compliance budget to hiring and retaining skilled compliance professionals. Understaffing compliance functions leads to errors, inefficiencies, and regulatory risks. Investing in expertise ensures compliance is a core business function—not an afterthought.

2. Data Management & Automation Tools

Relying on spreadsheets and email chains? That’s a compliance disaster waiting to happen.

Investing in automation saves money in the long run by:

- Reducing manual data entry errors.

- Automating supplier outreach and follow-ups.

- Generating real-time compliance reports.

Modern compliance platforms help teams do more with less, freeing up resources for high-value tasks.

Tip: Expect to allocate 40-60% of your compliance budget toward modern compliance platforms. While the upfront investment might seem high, automation helps teams do more with less, freeing up resources for high-value tasks like risk assessment and strategic decision-making.

3. Testing & Lab Costs

Even with full supplier disclosures, you’ll still need independent verification for certain materials.

Testing costs vary based on:

- The number of parts tested.

- The complexity of the analysis (chemical composition, PFAS screening, etc.).

- Lab accreditation requirements (ISO, IEC, etc.).

Tip: Budget 10-20% of your compliance funds for lab testing, especially if you work with high-risk suppliers or industries with strict regulations. A well-planned testing budget prevents expensive recalls and non-compliance penalties.

4. Training & Continuous Education

Compliance is a moving target. What’s compliant today might not be tomorrow.

To stay ahead, allocate budget for:

- Regulatory training for compliance, procurement, and engineering teams.

- Supplier education programs—engaged suppliers provide better data.

- Industry conference attendance to keep up with regulatory trends.

Compliance is only as strong as the knowledge behind it.

Tip: Set aside 5-10% of your compliance budget for continuous training and education. Keeping teams and suppliers informed reduces errors, speeds up compliance processes, and builds a proactive compliance culture.

5. Risk Contingency Fund

Surprises happen. Maybe a supplier fails to provide necessary documentation. Maybe a new regulation renders a material non-compliant overnight.

A contingency fund helps you:

- Cover unexpected testing and material substitutions.

- Respond quickly to new regulatory changes.

- Avoid costly last-minute supply chain disruptions.

Best practice: Allocate 5-10% of your compliance budget to handle these unknowns.

Tip: Allocate 5-10% of your compliance budget to a risk contingency fund. Unforeseen compliance costs can derail operations if not planned for—having a safety net allows your business to respond swiftly to emerging risks.

Common Budgeting Mistakes (and How to Avoid Them)

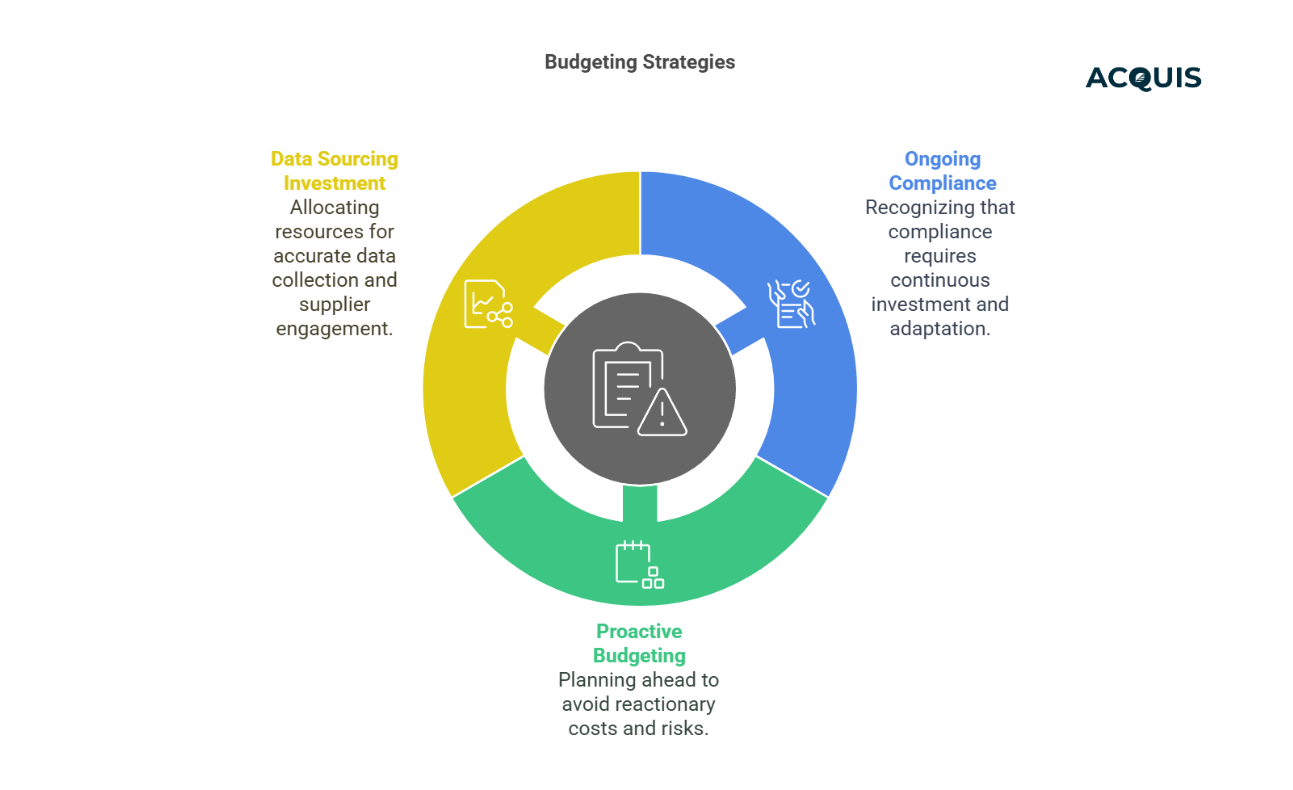

Mistake 1: Treating Compliance as a One-Time Cost

Reality: Compliance is ongoing, not a one-and-done task. Regulations evolve, suppliers change, and new materials enter your supply chain. Plan for continuous investment.

Mistake 2: Budgeting for the Bare Minimum

Reality: A minimal budget leads to reactionary compliance—where you only act when there’s a problem. This increases risk and emergency costs. Proactive budgeting prevents expensive surprises.

Mistake 3: Underestimating Data Sourcing Costs

Reality: Getting suppliers to provide accurate data takes time, training, and follow-up. Budget for supplier engagement efforts to maintain strong compliance data coverage.

How to Get Leadership Buy-In for Compliance Funding

Executives speak the language of risk and return. If compliance budget discussions hit resistance, focus on:

1. Cost of Non-Compliance

Lay out the financial risks:

- Regulatory fines ($50K–$100M per violation in some industries).

- Product recalls (averaging $10M+ in direct costs alone).

- Customer contract losses (companies have lost millions due to compliance failures).

2. ROI of Proactive Compliance

- Compliance automation reduces manual workload by 40-60%.

- A well-funded compliance program avoids costly last-minute redesigns.

- Strong compliance data boosts supplier trust and business reputation.

3. Competitive Advantage

Companies with robust compliance programs win more contracts. Many major OEMs prioritize suppliers who can quickly provide full compliance documentation.

Final Thoughts: Compliance is an Investment, Not an Expense

Compliance budgeting isn’t about spending more money—it’s about spending smarter.

- Plan for staff, tools, testing, and training.

- Allocate a risk contingency fund.

- Get leadership buy-in by demonstrating ROI and risk mitigation.

When done right, compliance budgeting keeps your company ahead of regulations, out of legal trouble, and primed for business growth.

Learn about Closing Data Gaps in Compliance—because even with a solid budget, missing compliance data can still derail your efforts.