Table of Contents

On May 10, 2023, the European Parliament and Council established the Carbon Border Adjustment Mechanism (CBAM) to prevent carbon-intensive imports from undermining the EU’s climate objectives. Businesses affected by CBAM must act now to ensure compliance and avoid penalties. This guide explains CBAM, its impact, and how importers can stay compliant.

What is CBAM?

CBAM is an EU regulation that imposes a carbon price on imported goods based on their embedded emissions. Importers must report emissions and purchase CBAM certificates to ensure fair competition with EU manufacturers and incentivize global carbon reduction efforts.

Need help with CBAM compliance? Request a CBAM consultation today.

Scope of CBAM & Affected Sectors

During the transitional phase (until December 31, 2025), CBAM requires importers to report emissions but does not impose financial charges. The mechanism applies directly to all EU member states without requiring national transposition.

Products Under CBAM (Annex I)

- Iron & Steel (including tanks, drums, containers)

- Aluminium

- Cement

- Fertilizers (nitric acid, ammonia, potassium)

- Electricity

- Hydrogen

Exemptions (Annex II)

CBAM does not apply to Iceland, Liechtenstein, Norway, and Switzerland (European Economic Area countries).

Emissions Calculation (Annex III)

Importers must report emissions and acquire CBAM certificates.

CBAM Timeline

- May 2023: CBAM ratified.

- October 1, 2023 – December 31, 2025: Transitional phase with quarterly emissions reporting (First report due January 31, 2024).

- January 1, 2026: Full CBAM implementation with financial obligations.

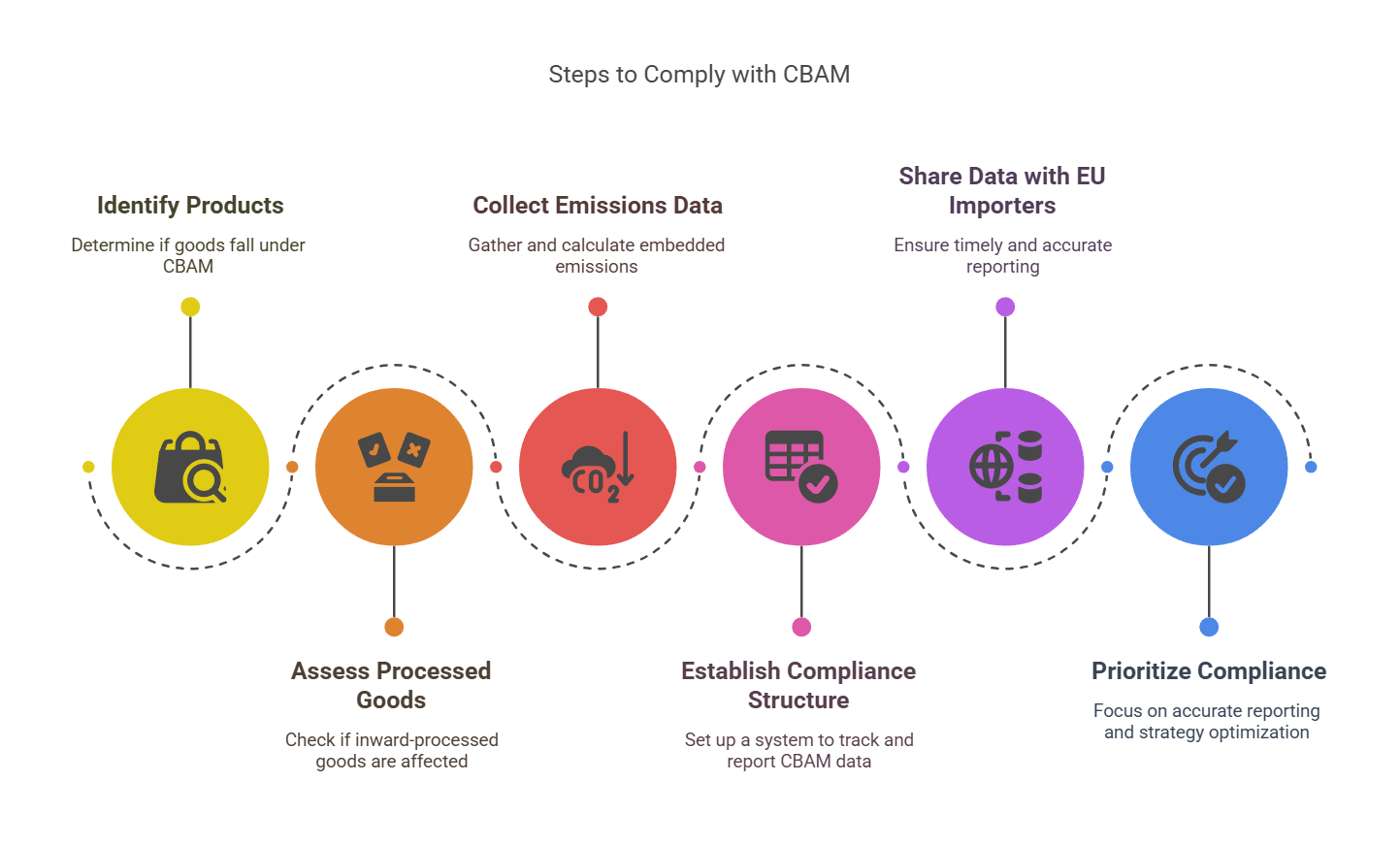

Steps to Comply with CBAM

- Identify Products: Determine if goods fall under CBAM.

- Assess Processed Goods: Check if inward-processed goods are affected.

- Collect Emissions Data: Gather and calculate embedded emissions. Use a CBAM tax calculation tool to simplify this process.

- Establish CBAM Compliance Structure: Set up a system to track and report CBAM data.

- Share Data with EU Importers: Ensure timely and accurate reporting.

- Prioritize Compliance:

- Transitional Phase (2023-2025): Focus on accurate reporting.

- Post-Transitional Phase (2026 onward): Optimize strategies to minimize carbon levies.

CBAM Reporting Obligations

Transition Period (Oct 1, 2023 – Dec 31, 2025)

- Quarterly reporting of imported goods and associated emissions.

- No financial charges yet, only emissions disclosure.

- No obligation to report to national customs authorities (e.g., Germany).

Full Implementation (Jan 1, 2026)

- Importers must purchase CBAM certificates for embedded emissions.

CBAM Report Requirements

Reports must include:

- Total imported quantity (in tonnes or megawatt-hours).

- Actual total emissions (CO₂ in tonnes per unit).

- Indirect emissions calculations.

- CO₂ price paid in the country of origin (adjusted for refunds or compensations).

Exemptions & Submission Process

Exemptions from Reporting

- Imports from EFTA countries.

- Goods under €150 per consignment.

- Personal luggage imports below €150.

Submission Process

- Reports must be submitted one month after each quarter.

- First report due January 31, 2024.

- Submitted via the provisional CBAM register (national authorities manage access).

CBAM’s Global Impact

- Trade Disruptions: Exporting countries with carbon-intensive industries face higher costs.

- Diplomatic Tensions: CBAM may spark trade negotiations and disputes.

- Policy Influence: Other countries might adopt similar measures.

- Competitive Adjustments: Non-EU exporters must align carbon policies to stay competitive.

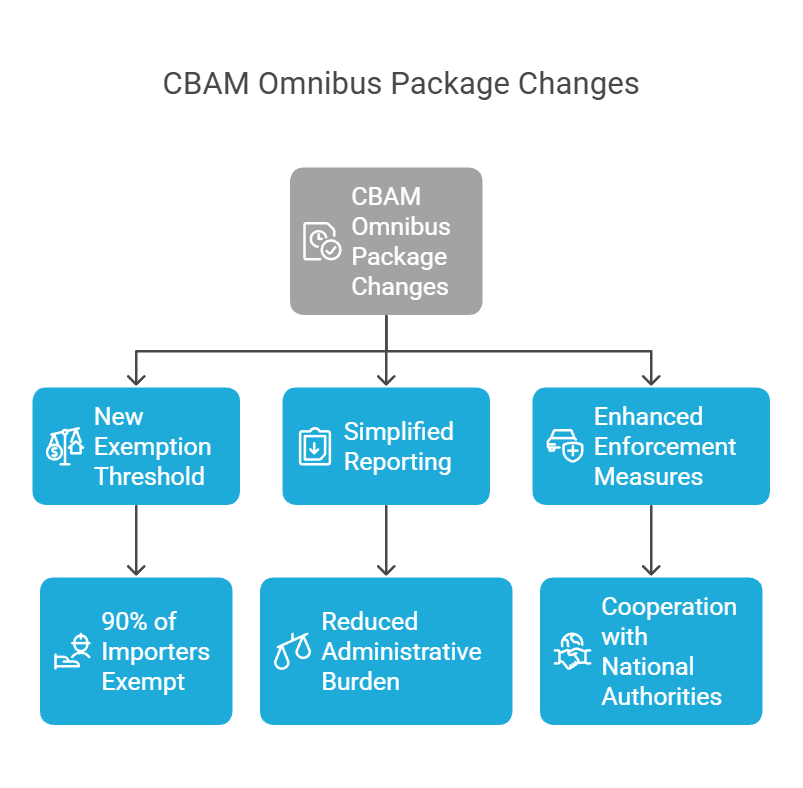

Recent Update to CBAM Requirements in EU OMNIBUS

On February 26, 2025, the European Commission introduced its Simplification Omnibus I and II proposals, aimed at reducing complexity in corporate sustainability reporting. These updates will have significant implications for CBAM, Corporate Sustainability Reporting Directive (CSRD), Corporate Sustainability Due Diligence Directive (CSDDD), and the EU Taxonomy Regulation.

Key Changes to CBAM in the Omnibus Package

- New Exemption Threshold:

- A cumulative annual threshold of 50 tons (approx. 80 tons of CO₂ eq.) will exempt 90% of importers from CBAM reporting obligations.

- Simplified Reporting:

- Emissions calculations and reporting requirements have been streamlined, reducing administrative burdens.

- Enhanced Enforcement Measures:

- Stricter anti-abuse and anti-circumvention provisions, in cooperation with national authorities.

- Stricter anti-abuse and anti-circumvention provisions, in cooperation with national authorities.

These proposals are now under review by the European Parliament and Council. Once approved and published in the EU Official Journal, the changes will take effect.

Conclusion

CBAM is reshaping global trade and climate policy, placing a cost on carbon-intensive imports to protect the environment and ensure fair competition. Businesses must prepare by collecting emissions data, optimizing reporting, and securing CBAM certificates. The Simplification Omnibus proposals could ease compliance for smaller importers while tightening enforcement for larger ones.

CBAM is not just an EU initiative—it’s reshaping global sustainability efforts and urging industries worldwide to transition toward cleaner production. The key to success? Adaptation and collaboration—both within the EU and on a global scale.

Stay ahead of CBAM regulations – Request a compliance audit today.