Table of Contents

For two years, the EU’s Carbon Border Adjustment Mechanism (CBAM) operated in a transitional phase. Importers filed quarterly emissions reports, customs authorities tested data flows, and the European Commission assessed what worked—and what didn’t.

On 8 October 2025, that transition formally ended.

With the adoption of Regulation (EU) 2025/2083, the EU amended Regulation (EU) 2023/956, rewriting key operational elements of CBAM. The direction is clear: CBAM is no longer a pilot climate tool—it is now a fully enforceable carbon-pricing mechanism embedded in EU customs law.

Why the CBAM Amendment Was Necessary

The Commission’s review of the transitional period highlighted a structural imbalance:

- A small number of importers account for the overwhelming majority of embedded emissions

- Thousands of low-volume importers faced heavy reporting obligations with negligible climate impact

- Customs representation rules lacked clear accountability

- Reporting deadlines and certificate logistics were misaligned with operational reality

Regulation (EU) 2025/2083 addresses these issues directly—reducing administrative burden where climate impact is minimal, while tightening control where emissions exposure is material.

This is not a rollback. It is operational enforcement.

What Changed Under Regulation (EU) 2025/2083

1. 50-Tonne De Minimis Threshold

Importers whose total annual CBAM-covered imports of iron & steel, aluminium, cement, and fertilisers do not exceed 50 tonnes are now exempt from:

- CBAM reporting obligations

- CBAM certificate purchase obligations

Key clarifications:

- The threshold applies to total annual mass, not per shipment

- Once exceeded, the entire year’s imports fall under CBAM

- Electricity and hydrogen remain fully covered—no exemptions apply

This change preserves CBAM coverage for approximately 99 % of embedded emissions, while removing low-impact reporting noise.

*“Operational and procedural requirements are further detailed in Implementing Regulation (EU) 2025/2620, applicable from 1 January 2026.”*bold text

2. Authorised CBAM Declarant — Liability Clarified

Indirect customs representatives must now be formally authorised to submit CBAM declarations.

- Authorised representatives carry the same liability and penalties as importers

- The former grey zone in customs representation is closed

CBAM filings are no longer administrative placeholders—they are legally accountable declarations.

3. Simplified Reporting and Revised Deadlines

- Annual CBAM declarations are due by 30 September

- First full annual filing: 2027, covering 2026 imports

- Only actual emissions require third-party verification

- Default values are issued by the Commission where supplier data is unavailable

This aligns CBAM with verification capacity and reduces unnecessary audit cost.

4. Carbon-Price Recognition Outside the EU

Importers may deduct verified carbon prices paid in third countries from their CBAM liability.

To standardise this:

- The Commission will publish annual default carbon prices by country (€/t CO₂e)

- This reduces manual audits and cross-border disputes

Carbon-price recognition is now operational, not theoretical.

5. Central CBAM Certificate Platform (from 2027)

From February 2027, CBAM certificates will be sold through a single EU-level platform.

- Prices aligned with EU ETS allowance averages

- Transparent availability and purchasing

- Fee-based model designed to self-finance system administration

CBAM is now structurally aligned with EU ETS.

6. Penalties Aligned with EU ETS

CBAM penalties now mirror EU ETS enforcement:

-

Up to €100 per missing tonne of CO₂e, indexed annually

-

Authorities retain discretion for minor, good-faith errors

-

Full penalties apply for:

- Artificial threshold splitting

- Unauthorised declarations

- Material misreporting

CBAM enforcement is now carbon-pricing enforcement.

What This Means for Importers and Manufacturers

Regulation (EU) 2025/2083 is a reset of operational expectations, not a policy shift.

- Small importers gain relief through the 50-tonne exemption

- Large importers face a zero-tolerance data environment with verification and automated customs checks

- Indirect representatives become accountable compliance actors

- Audit intensity and penalties now fully align with EU ETS

CBAM has moved from climate ambition to customs-enforced reality.

How Acquis Makes CBAM Operationally Practical

For most companies, the challenge is no longer what CBAM requires—it’s how to keep it auditable, supplier-linked, and verifiable at scale.

Acquis CBAM Automation Suite addresses the real bottlenecks:

- Mass-based threshold tracking across suppliers and CN codes

- Automated emissions validation using supplier CoCs and Commission defaults

- Carbon-price deduction logic with country-level reference tables

- CBAM certificate management dashboards aligned to EU ETS averages

- Declarant-status and authorisation tracking for customs representatives

Acquis converts Regulation (EU) 2025/2083 from a compliance risk into a controlled, audit-ready data system.

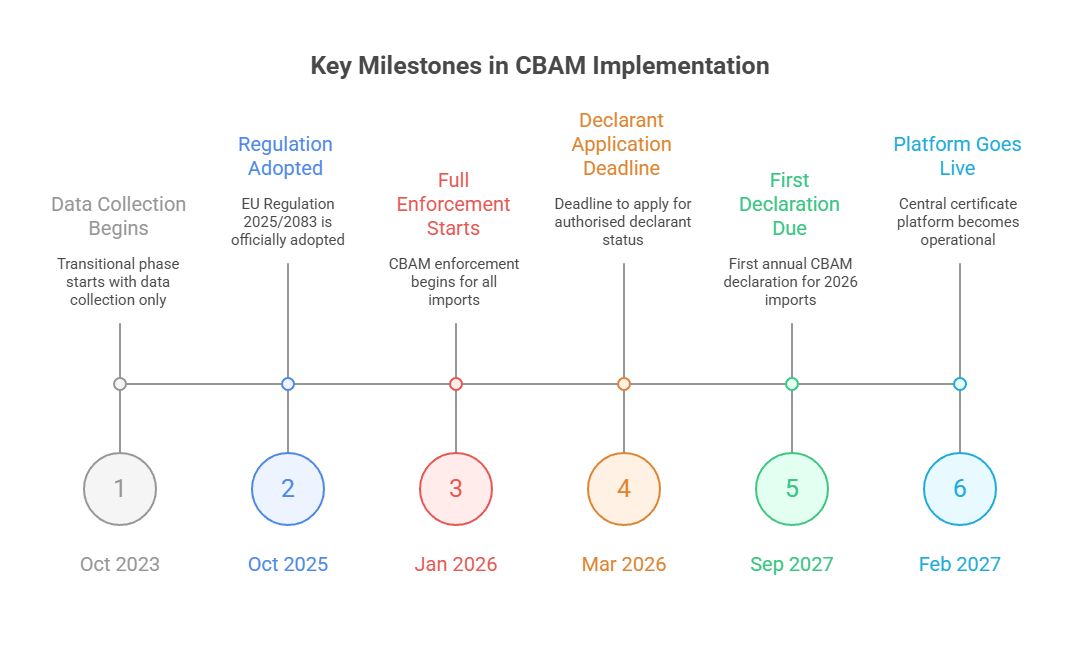

CBAM Key Timeline

Prepare for 2026 CBAM Enforcement Now

Imports in 2026 will be the first fully enforceable CBAM year. Waiting until filing season guarantees errors, penalties, and supplier disputes.

Last updated: January 2026 — aligned with Regulation (EU) 2025/2083 and current Commission guidance.