Table of Contents

What Are Rare Earth Elements, and Why Do They Matter?

Rare earth elements (REEs) are a group of 17 metals, including the 15 lanthanides plus scandium and yttrium. They are essential to modern technology powering EV motors, wind turbines, semiconductors, magnets, sensors, defense systems, and AI hardware.

While not geologically scarce, REEs are difficult to extract and refine. China controls roughly 60–70% of global production and nearly 90% of processing capacity. This dominance makes REEs one of the most strategic raw materials on the planet — and now, one of the most politically sensitive.

What the New Regulation Does

On October 9, 2025, the Ministry of Commerce (MOFCOM) issued Notice 2025 No. 61: Decision to Implement Controls on Exports of Rare Earth-Related Items to Foreign Countries.

The new measure, effective December 1, 2025 (with partial immediate effect), expands China’s export controls on REE-related materials. Here’s the summary — without the legal fog:

-

Foreign companies must obtain a Chinese export permit if they export any product containing even trace amounts (≥ 0.1%) of Chinese-origin rare earths.

- This includes goods manufactured outside China but containing REEs originally produced in China.

- Targeted products include permanent magnet materials, sputtering targets, and semiconductor/AI components.

-

High-risk end uses are restricted or banned outright, including exports:

- To foreign military entities or controlled users;

- For WMD applications, AI with military potential, or advanced semiconductor manufacturing (≤ 14 nm logic, ≥ 256-layer memory).

-

A “Declaration of Compliance” becomes mandatory for every transfer, detailing:

- The percentage of Chinese-origin REE content;

- A promise not to re-export or use the materials in ways that harm China’s security interests.

In short: China is now controlling not only what leaves its borders — but also what happens abroad with materials it originally produced.

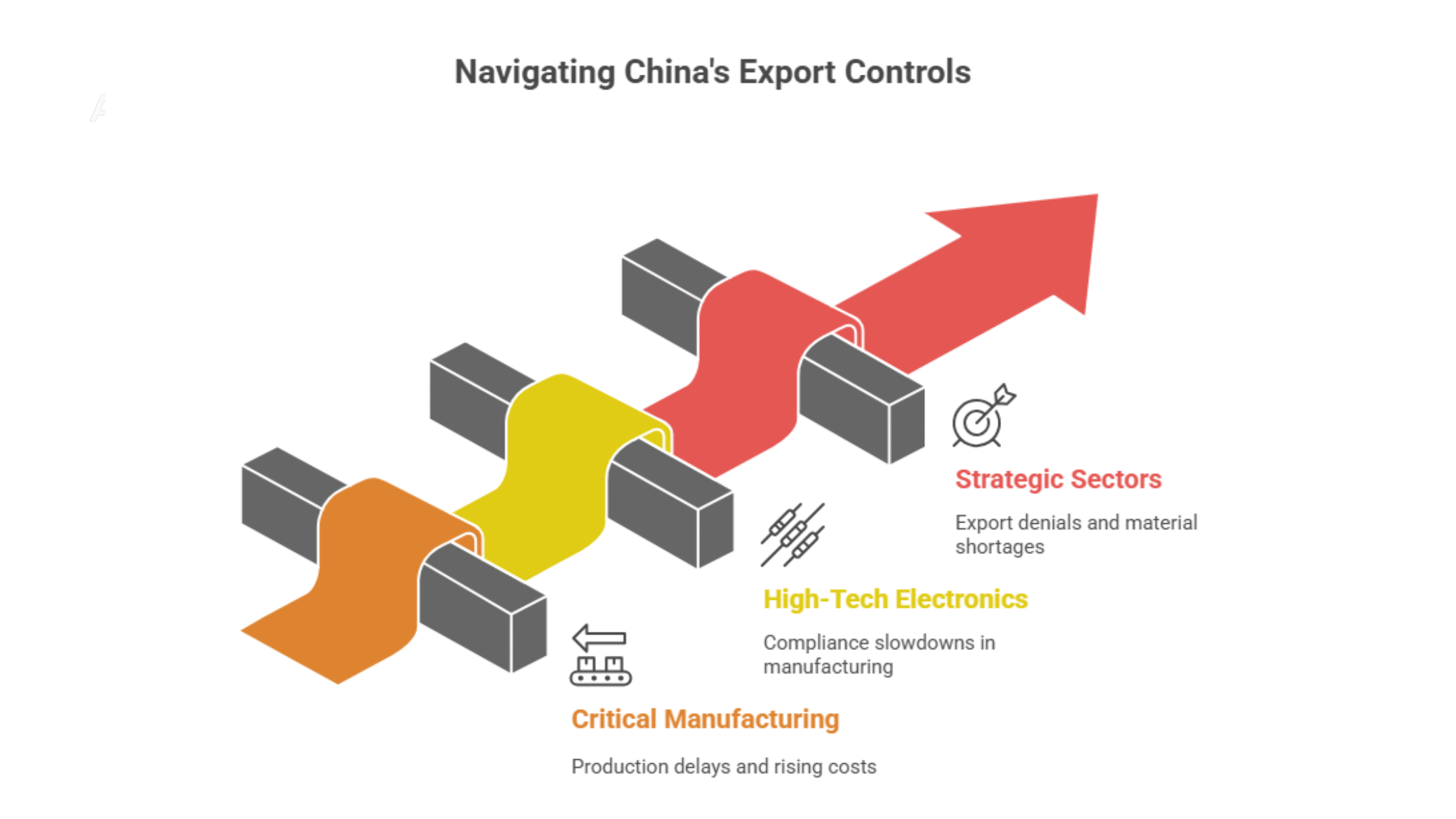

Industries Facing the Biggest Impact

China’s export controls aren’t abstract policy—they’re a direct supply-chain and compliance shock hitting multiple sectors. Below are the key industries most exposed to MOFCOM Notice 61.

1. Critical Manufacturing and Energy

- Automotive & EVs: Traction motors and sensors rely on NdFeB magnets with dysprosium and terbium—nearly all refined in China.

- Wind Energy: Direct-drive generators use REE magnets; projects risk cost spikes if Chinese-origin content exceeds the 0.1 % limit.

- Industrial Automation & Robotics: Servo motors and encoders depend on high-grade magnets that are overwhelmingly China-sourced.

Risk: Production delays, licensing bottlenecks, and rising magnet costs across the clean-tech and industrial sectors.

2. High-Tech and Electronics

- Semiconductors & AI Hardware: Sputtering targets (yttrium, gadolinium, terbium, samarium) now require export permits—even if wafers are made abroad.

- Consumer Electronics: Smartphones, laptops, HDDs, and speakers all embed REE magnets, multiplying traceability burdens.

- Telecom & Optics: Fiber amplifiers and laser optics using erbium and yttrium face documentation and licensing scrutiny.

Risk: Compliance slowdowns in global chip and electronics manufacturing, particularly for sub-14 nm semiconductors and AI devices.

3. Strategic and Regulated Sectors

- Defense & Aerospace: Guidance, radar, and satellite actuators fall under near-automatic denial—military end uses are explicitly restricted.

- Medical Devices: MRI scanners and surgical lasers depend on REE-doped crystals (holmium, erbium, ytterbium).

- Nuclear & Advanced Energy: Control rods and shielding materials using holmium or europium are caught in the expanded control list.

Risk: Export denials and material shortages in mission-critical or dual-use applications.

Why It Matters for Global Supply Chains

This is more than a trade regulation. It’s a strategic weaponization of supply-chain leverage — and it directly affects every manufacturer using magnets, sensors, or advanced chips.

1. The Compliance Trap

Even if your manufacturing site is in Europe, the U.S., or Japan, you may be unknowingly using Chinese-origin dysprosium, terbium, or samarium in your magnets or alloys. If that REE content represents more than 0.1% of the item’s value, it’s now under Chinese jurisdiction. Result: Your shipment may require a MOFCOM export permit — even when China isn’t part of your transaction route.

2. Documentation and Traceability Pressure

MOFCOM Notice 61 requires every participant in the chain — suppliers, distributors, importers — to issue and retain a Declaration of Compliance. If any node fails, your export may be blocked or flagged for investigation. Traceability from mine → refinery → component → end product is no longer optional.

3. Cost and Availability Shocks

With additional licensing, some Chinese REE exports could slow or stop entirely. Expect price volatility in:

- Permanent magnets (NdFeB, SmCo)

- Sputtering targets for semiconductors

- EV and wind turbine components Companies relying on just-in-time procurement will be the first to feel the squeeze.

How Suppliers Can Measure and Manage the Impact

1. Map Your Rare Earth Exposure

- Inventory every component containing magnetic or alloy materials.

- Identify the REE type (e.g., dysprosium, terbium, yttrium).

- Trace the origin — where was it mined, refined, alloyed?

- Quantify the value share (%) of Chinese-origin REEs per item.

A clear REE Bill of Materials (REE-BoM) is now a compliance necessity.

2. Conduct Risk Scoring

Use a 3-tier system:

- High Risk: Contains REEs from Chinese suppliers; dual-use end user; value ≥ 0.1%.

- Medium Risk: Unknown origin; used in industrial equipment.

- Low Risk: Verified non-Chinese source or below 0.1%.

Prioritize documentation and alternative sourcing for high-risk items.

3. Build a Declaration Workflow

Create an internal template mirroring MOFCOM’s Appendix 2 Declaration of Compliance, including:

- Product ID, REE type, value %, origin proof, and downstream customer confirmation. Automate this via your Supplier Relationship Management (SRM) or ERP system to prevent manual errors.

4. Diversify Supply Sources

Evaluate suppliers in:

- Australia, U.S., Vietnam, India, Canada — all expanding REE mining and refining.

- Partner with recyclers to recover REEs from scrap magnets or e-waste. A mixed sourcing portfolio reduces exposure to sudden Chinese export freezes.

5. Strengthen Supplier Communications

Inform your customers and upstream vendors now, not later. Explain how Notice 61 changes declaration duties, documentation, and potential delays. Transparency will minimize contractual risks once the rules take effect in December 2025.

What This Signals for the Future

China�’s MOFCOM Notice 61 is the clearest indication yet that export controls are the new geopolitical currency. By tightening control over rare earths, China is effectively testing how far supply-chain dependence can be used as leverage in the global semiconductor and AI race.

For suppliers, this means compliance and business continuity are now intertwined. Those who treat regulatory intelligence as a core operational function — not just legal overhead — will outpace the rest.

Next Steps with Acquis Compliance

- Automate Rare Earth Traceability: Our FMD and RoHS modules already support origin tagging and material composition thresholds.

- Supplier Risk Monitoring: Use Acquis SRM integration to flag Chinese-origin REEs above 0.1%.

- Compliance Declarations: Generate and manage MOFCOM-style export compliance statements directly from your workflow.

Prepare before December 1, 2025. Acquis Compliance helps suppliers stay compliant, resilient, and ready for the next wave of geopolitical export controls.