Table of Contents

The Currency of Climate – Understanding Basics of Carbon Markets

At its core, a carbon market is a financial system that turns greenhouse gas (GHG) emissions into a tradable commodity. The fundamental logic is to put a price on carbon, thereby creating a financial incentive for companies and nations to reduce their emissions. one carbon credit or allowance typically equals one tonne of carbon dioxide equivalent (CO2e) reduced, removed, or avoided from the atmosphere.

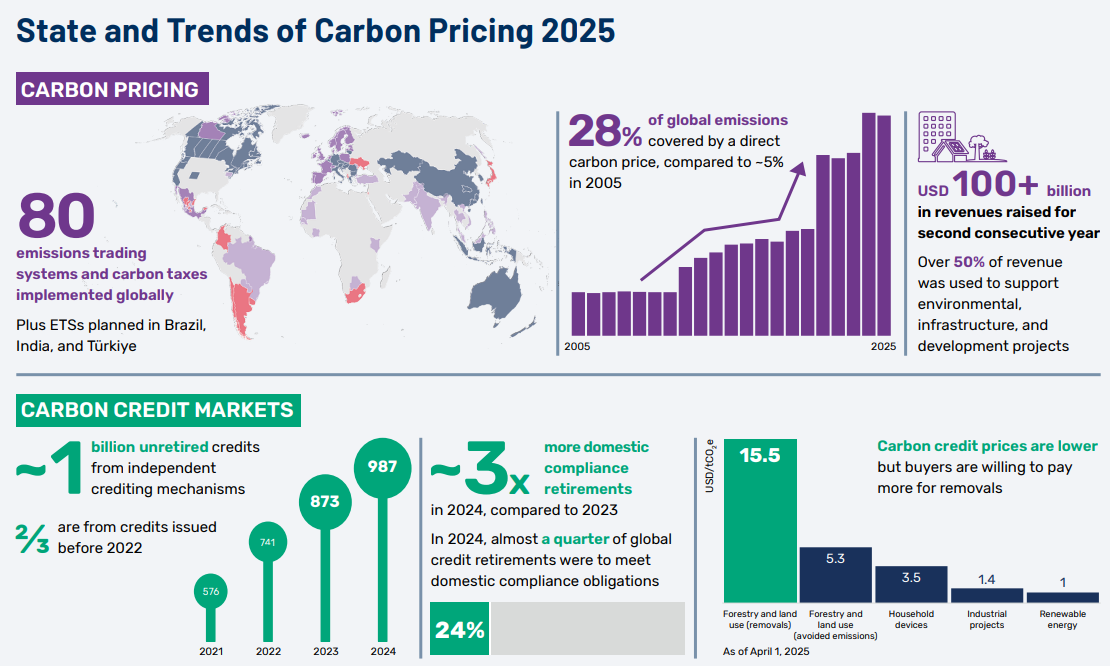

Source: World Bank Group (2025)

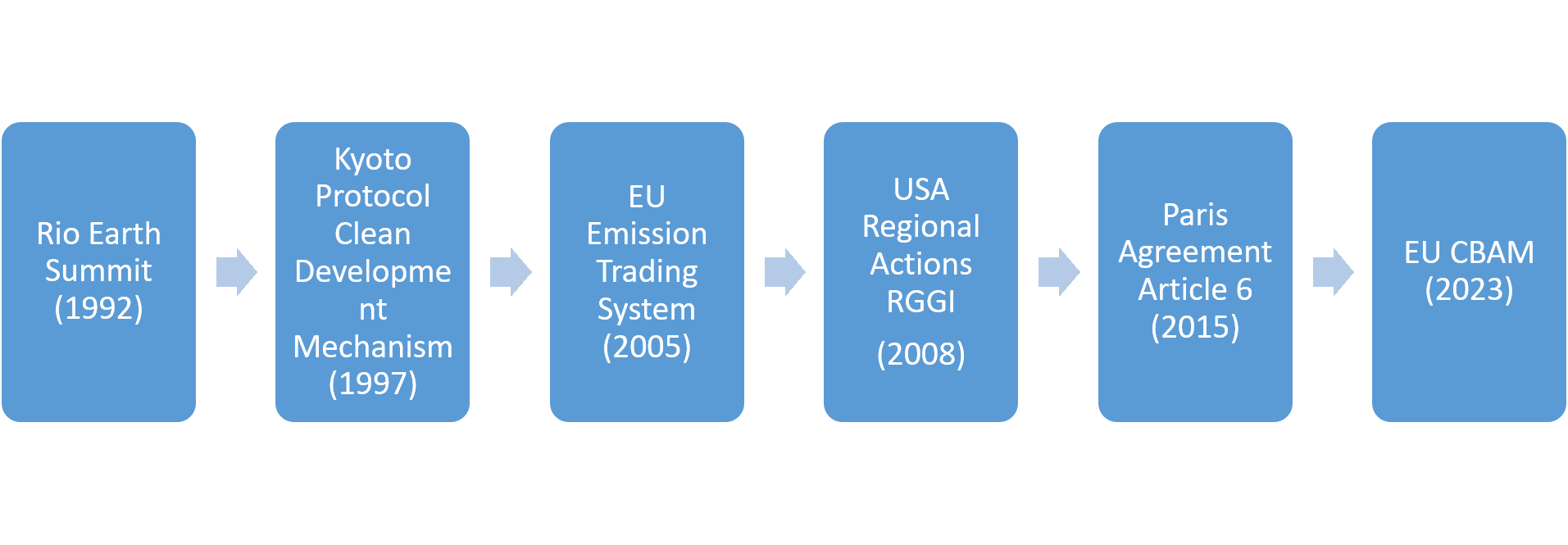

The evolution of carbon markets reflects a historic shift from theoretical economic concepts to a global financial infrastructure for climate action. It began in the 1960s with the "Coase Theorem," which proposed treating pollution as a tradeable property right, a concept successfully piloted in the 1980s by the U.S. to combat acid rain. This market-based success paved the way for the 1997 Kyoto Protocol, which established the first international compliance framework, introducing mechanisms like the Clean Development Mechanism (CDM). Over the following decades, the market matured with the launch of the EU Emissions Trading System (ETS) in 2005 and the growth of Voluntary Carbon Markets (VCM). Today, under the Paris Agreement’s Article 6, the system is undergoing a "high-integrity" revolution, moving away from simple offsetting toward transparent "contribution claims" and rigorous global standards to ensure that every credit represents a real, verifiable reduction in global emissions.

Carbon markets are designed to lower the cost of climate action. By allowing entities to trade emission reductions, the market ensures that abatement happens where it is cheapest and most efficient or regulated by domestic market. There are two major categories of carbon market:

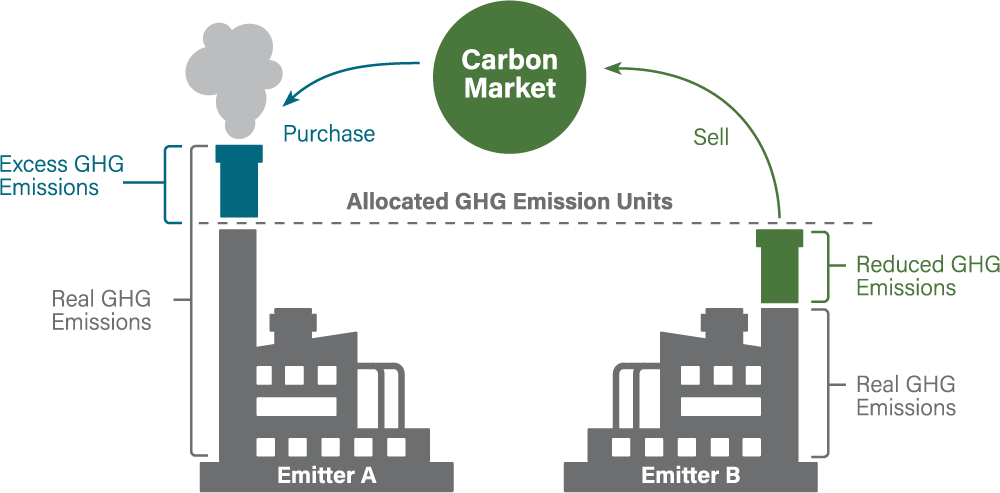

• Cap-and-Trade (Emissions Trading Systems - ETS): A regulator sets a limit (cap) on total emissions. Companies receive or buy allowances based on their emission limits. if a company emits less than its limit, it can sell its surplus allowances to a company that is struggling to meet its cap and emits more than its limits.

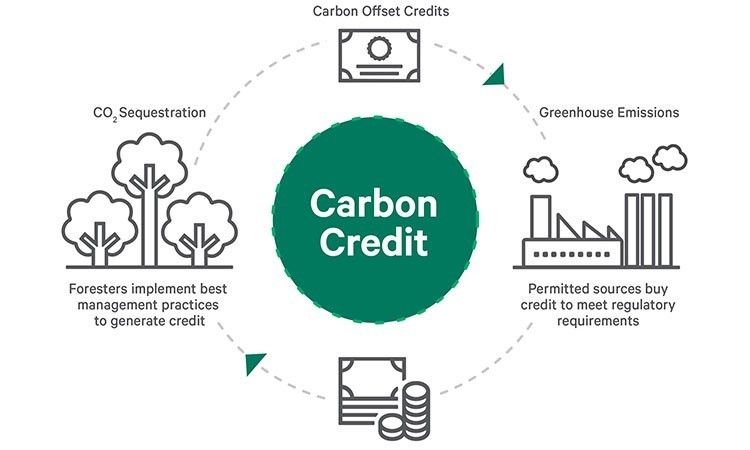

• Crediting Mechanisms (Offsetting): Projects that reduce or remove emissions (like a Solar, wind farm or a reforestation project) generate carbon credits. These credits can be sold to companies that want to "offset" their own emissions. It can be voluntary and compliance set of emission reductions.

While from demand side, carbon market can be divided into compliance and voluntary, when demands drive by compliance and legal duties termed as compliance market and when demand is driven by self-regulatory targets termed as voluntary market.

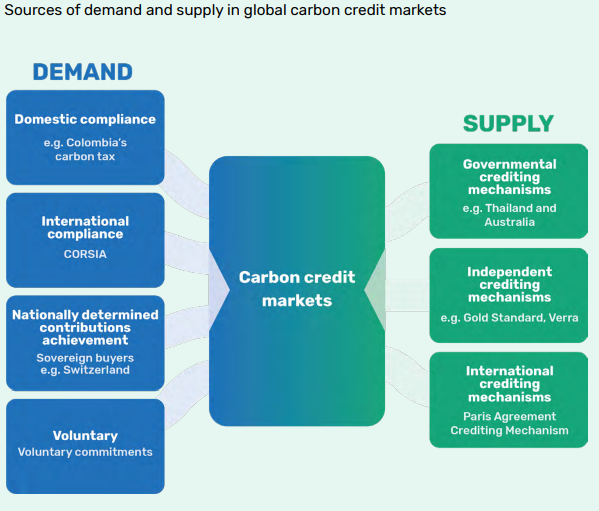

Economic theory is fundamentally driven by the mechanisms of supply and demand, for carbon markets to be relevant and effective, they must operate under these same principles. Demand is largely fuelled by domestic and international compliance requirements, as well as voluntary, self-regulatory commitments such as RE100 and CDP. On the supply side, the market is more decentralized, drawing from afforestation, renewable energy, and energy-saving certificates and many more. Additionally, government and international oversight are essential in managing this supply to ensure the ongoing integrity of carbon credits.

Why Is This Important for Your Organization?

Engaging with carbon markets is no longer just a Corporate Social Responsibility (CSR) or ESG exercise instead it is becoming a core component of financial and operational strategy. In many jurisdictions, participation and following the compliance of carbon market is mandatory. For instance, USA’s California cap and trade market, RGGI, WCI, LCFS and the EU ETS, CBAM markets covers major industries and businesses. Similar systems are emerging in developing countries like India and China.

Financial Risk & Opportunity: Carbon pricing introduces a cost for polluting. Conversely, organizations that decarbonize can turn their emission reductions into revenue by selling credits. This gives an opportunity to get financial incentive on your green capital and investments.

Net-Zero Commitments: As companies pledge to become "Net Zero," they often need carbon credits to compensate for residual emissions that cannot be eliminated immediately. Recently we have seen the Apple making its product Net Zero emission products, which gives a business edge for the major organisations.

The Impact on Organizations The impact is twofold:

-

Cost of Operations: For high-emitting sectors (Iron, Steel, Cement, Power), carbon pricing acts as a direct cost, necessitating efficiency upgrades or a shift to cleaner fuels. This can impact negatively to these industries.

-

Competitive Advantage: Early movers who understand these markets can secure carbon credits at lower prices or develop low-carbon products that command a premium in environmentally conscious markets. This will make the industries more efficient and cost efficient in future.

As carbon markets transition from theoretical economic concepts to rigorous global financial systems, they are redefining the meaning of corporate value. The evolution toward "high-integrity" frameworks means that the ability to navigate these markets is no longer optional but it is a strategic necessity. Whether driven by mandatory compliance or voluntary net-zero pledges, organizations that successfully integrate carbon pricing into their operational DNA will mitigate financial and legal risk and unlock new revenue streams. Ultimately, the carbon market is more than a trading system and it is the primary mechanism for the next era of global competition, where the most efficient and decarbonized organizations will lead the market.