Table of Contents

Every waiver is a warning shot. Each one expires faster, covers less, and leaves manufacturers with fewer excuses. By 2026, the safety net is gone.

Buy America compliance is no longer a bureaucratic checkbox; it’s a sourcing strategy. If your supply chain still leans overseas, you’re standing on borrowed time.

From the 1933 BAA to the 2025 BABA Enforcement Wave

The Buy American Act (BAA) was enacted in 1933 to keep federal tax dollars circulating inside the U.S. economy. Its premise was simple: government purchases should support domestic industry.

But as infrastructure spending exploded in the 1970s and ’80s, states were using federal funds to import materials. Congress responded with the Buy America provisions (1982) under the Department of Transportation (DOT) — extending domestic preference to highways, rail, and transit.

Four decades later, the Build America, Buy America Act (BABA) enacted under the Infrastructure Investment and Jobs Act (IIJA) in 2021 finished the loop. It applied domestic-sourcing rules to almost every federally funded infrastructure program, from water systems to broadband.

What began as a Depression-era jobs law has evolved into a modern industrial policy. The waivers we see today aren’t loopholes, they’re controlled decompression valves to buy time while the U.S. rebuilds its manufacturing base.

What Buy America Really Means

Under 49 U.S.C. § 5323(j), the Federal Transit Administration (FTA) cannot fund a project unless the steel, iron, and manufactured goods are produced in the United States.

-

Rolling stock (trains, buses, vans):

- ≥ 60 % U.S. content (FY 2016-17)

- ≥ 65 % (FY 2018-19)

- ≥ 70 % (FY 2020 onward)

- Final assembly must occur in the U.S.

-

Manufactured goods: 100 % U.S.-made, including all components.

-

Construction materials: Added under BABA, expanding domestic preference beyond transport.

Waivers are possible only when compliance is technically or economically impossible and those windows are rapidly closing.

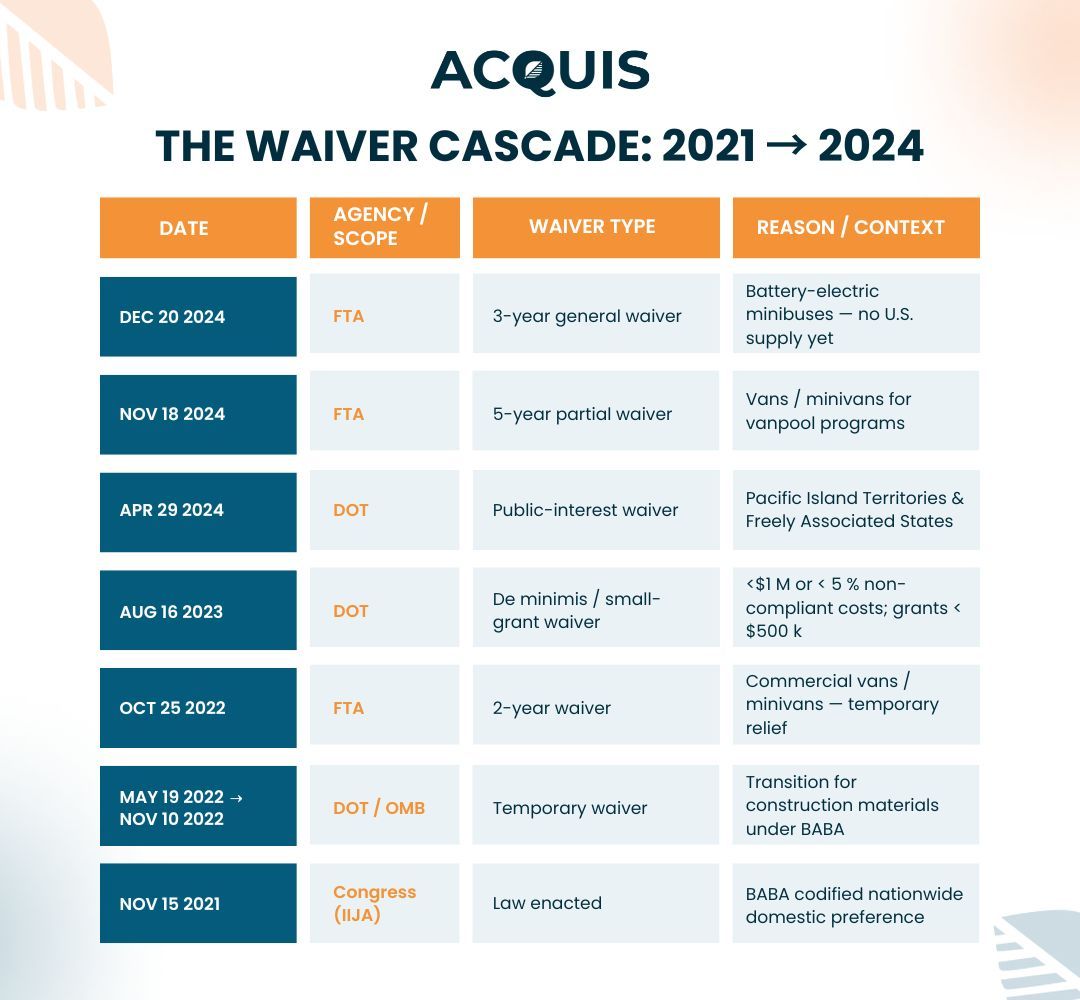

The Waiver Cascade: 2021 → 2024

Each waiver was phased and time-bound. None are permanent. DOT and FTA have made clear these were transition tools, not carve-outs.

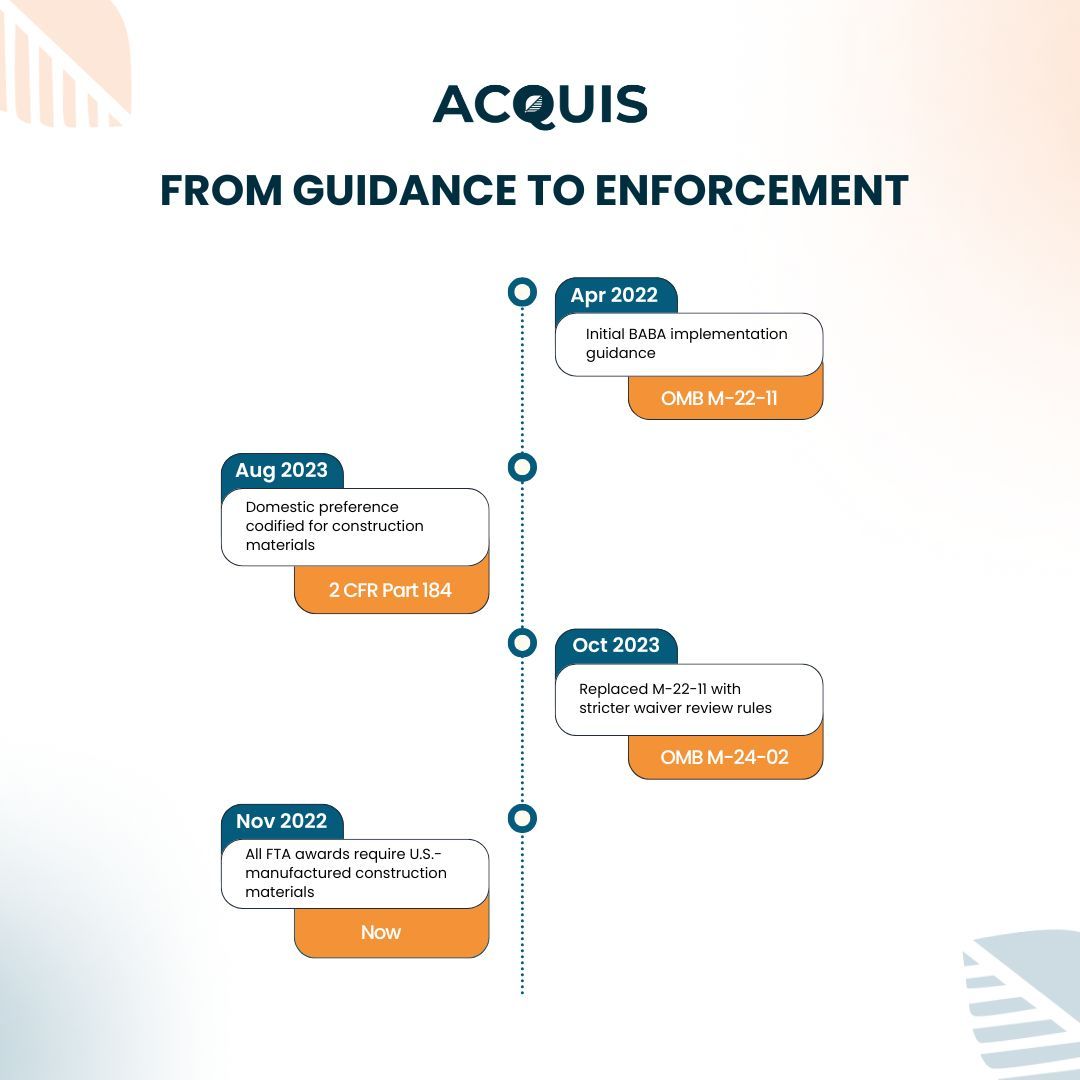

From Guidance to Enforcement

Every memo since 2022 has moved in one direction — from flexibility to enforcement. Federal auditors now demand component-level traceability, not PDFs and promises.

Manufacturer Playbook: Surviving the Post-Waiver Era

- Run a Domestic Content Gap Audit – Identify imported subcomponents > 30 % of BOM value.

- Build a Supplier Localization Map – Prioritize critical imports with no U.S. equivalent.

- Automate Certificate of Origin Tracking – Waivers will no longer cover manual errors.

- Monitor Federal Register Updates Monthly – Set alerts for FTA, DOT, OMB notices.

- Document Everything – 49 CFR §§ 661.6 & 661.12 require certificates at bid submission; missing one is grounds for rejection.

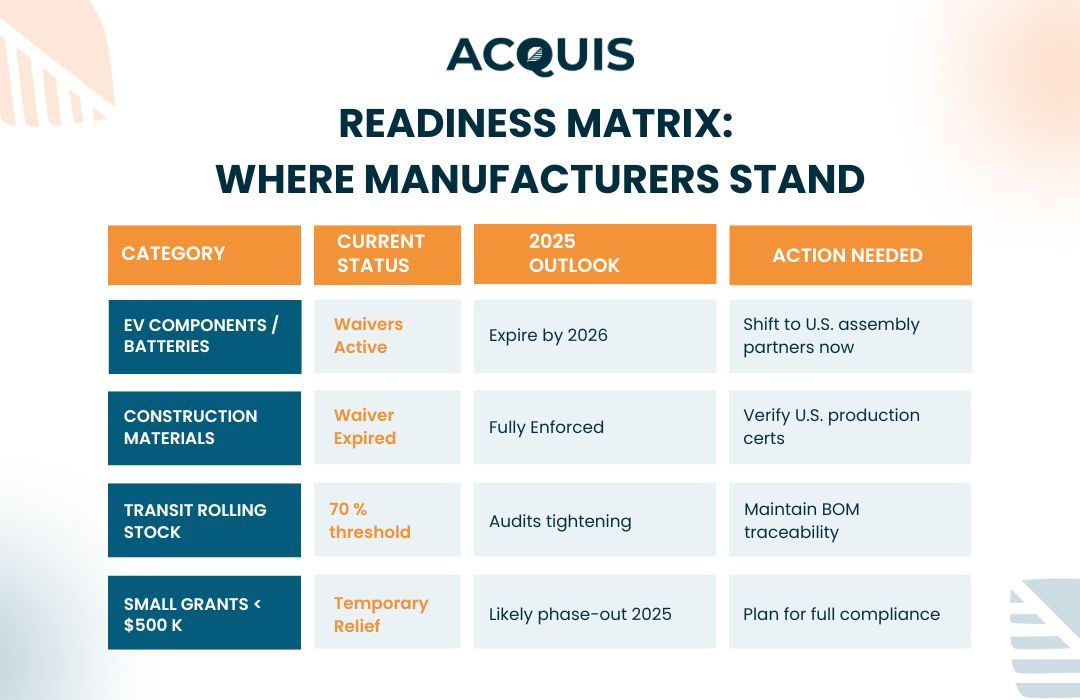

Readiness Matrix: Where Manufacturers Stand

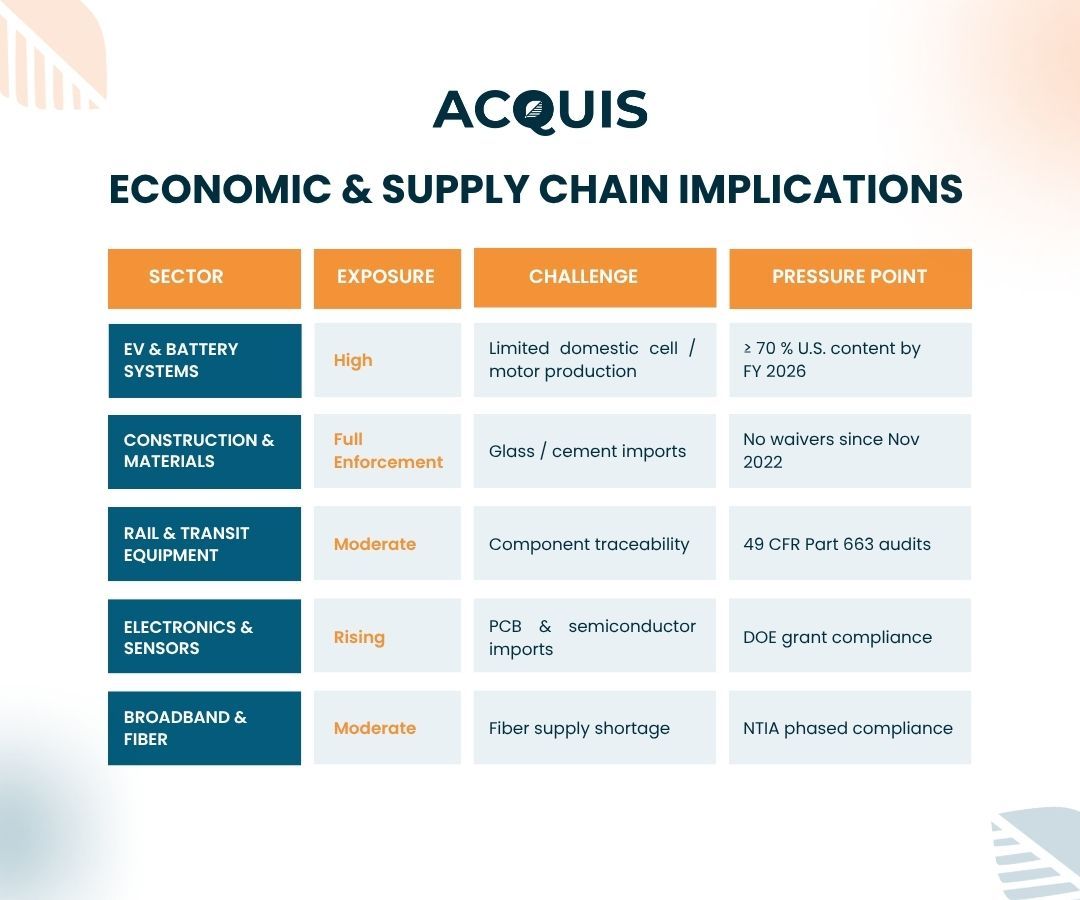

Economic & Supply Chain Implications

Each of these sectors faces a two-year localization sprint. Those banking on indefinite waivers will find themselves ineligible for funding by FY 2026.

The Road Ahead: Post-Waiver America (2026–2030)

By 2026, the transition period ends, but the oversight only intensifies.

Expect:

- AI-driven enforcement: OMB’s Made in America Office is testing data tools to cross-verify supplier claims against import records.

- Cross-agency integration: DOT, DOE, EPA, and Commerce are aligning Buy America rules under shared data standards.

- Digital Certificates of Origin (D-CoC): Blockchain-based traceability pilots expected by 2027.

- Localization incentives: New “Buy Clean” and IRA-linked tax credits for domestic manufacturers.

The message is clear: the era of paper declarations is over. Compliance will be digital, continuous, and auditable.

Acquis Perspective

Acquis Compliance analysts interpret the current waivers as short-term relief, not policy exceptions. The language is consistent with “phased,” “limited,” and “transition.” Washington is signaling a permanent Buy America baseline across all federal funding streams.

Acquis is already integrating Buy America and BABA rule sets into its Supplier Compliance Intelligence module, linking BOM-level origin data, supplier certificates, and OMB waiver feeds in real time.

As agencies move toward data-verified audits, Acquis becomes the compliance engine manufacturers rely on to stay eligible, not reactive.